Ranking of the World's Top 10 Refrigerated Upright Cabinet Suppliers and Industry Analysis

As a core device in commercial cold chain, refrigerated upright cabinets are widely used in supermarkets, convenience stores, restaurant chains and other scenarios. Their technological innovation and market landscape profoundly influence the development of global cold chain logistics. Combining authoritative industry reports and market data, the following analyzes the competitive landscape of the world's top 10 refrigerated upright cabinet suppliers from three dimensions: technological strength, market share, and product innovation.

I. Global Refrigerated Upright Cabinet Market Landscape and Technological Trends

Market Concentration and Competitive Barriers

The global refrigerated upright cabinet market presents an oligopolistic competition pattern, with the top ten manufacturers accounting for a combined 71% of the market share. Leading enterprises build competitive barriers through technological patents, large - scale production, and global layout. For example, Hailong Cold Chain, with its modular design and cost advantages, has a 35% share in Southeast Asian supermarket cold chain projects. Haier Smart Home, by integrating the global supply chain, has increased the penetration rate of its freezers in North American convenience store scenarios to 22%.

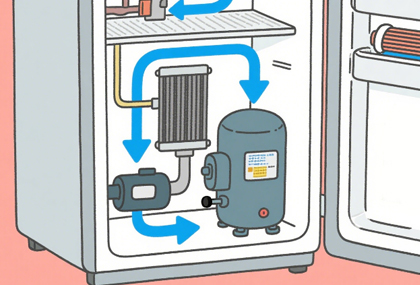

Technological Innovation Driving Industry Upgrade

Environmental Friendliness: The application of natural - working - fluid refrigerants (such as R290) is accelerating. Liebherr's laboratory freezers use R290 refrigerant, reducing energy consumption by 18% and meeting EU environmental standards.

Intelligence: Panasonic's AIoT freezer system can monitor equipment energy consumption and temperature fluctuations in real - time, shortening the fault - warning response time to within 15 minutes. AUCMA's "Yilanzhongbing" IoT platform is connected to nearly one million devices, achieving full - life - cycle management from production to after - sales.

Customization: Huamei Freezers customized a vertical freezer for Guoquan. It uses air - cooling technology to solve the icing problem of coil - tube refrigeration and established a 24 - hour service team to provide "nanny - style" support.

II. In - depth Analysis of the World's Top 10 Refrigerated Upright Cabinet Suppliers

Haier Smart Home

As a global home appliance giant, Haier is renowned for its comprehensive technology in the refrigerated upright cabinet field. Its vertical freezer product line ranges from - 40℃ ultra - low - temperature storage (such as the BD - 336WSPG model) to intelligent air - cooling frost - free (such as the Ailite series). The original creation "dual - frequency + full - space ion antibacterial" technology can achieve 0.1℃ precise temperature control and a 99.9% antibacterial rate. Data in 2024 shows that Haier freezers have topped the global retail volume for 13 consecutive years, and vertical freezers have a market share of over 15% in the high - end markets of North America and Europe.

Midea Group

Midea has built an advantage in the entire industrial chain from compressors to complete machines by integrating KUKA robots and Toshiba technology. Its vertical freezers use the "refrigerant ring" heat - dissipation technology, which can operate stably in a 43℃ high - temperature environment, meeting the needs of supermarkets in tropical regions. The ML278LDGE air - cooling display cabinet launched in 2025 has a 25% increase in energy efficiency ratio and has been supplied in batches to 7 - Eleven stores in Southeast Asia.

AUCMA

AUCMA is expert in low - temperature technology. Its - 60℃ household vertical freezer uses cell - level fresh - keeping technology, with a freezing capacity six times that of traditional freezers. It can store high - end ingredients such as salmon and tuna for up to two years. In the commercial field, the three - temperature - zone display cabinet (freezing - 18℃/refrigerating 0 - 4℃/room temperature) customized for Hema Fresh has a configuration rate of 85% in Hema's new stores opened in 2024.

Hailong Cold Chain

As a leading domestic commercial cold - chain enterprise, Hailong Cold Chain's vertical frozen display cabinets are exported to more than 80 countries, with a 35% market share in Southeast Asia. Its core product, the KD1271GT4 four - door all - freezer, uses a multi - cycle refrigeration system to achieve ±0.5℃ temperature fluctuation control and is widely used by restaurant chains such as Lao Xiang Ji and Yang Guofu.

Panasonic (Hussmann)

Hussmann, a brand under Panasonic, leads in the technology of vertical freezers for retail scenarios. The P - series remote - placed multi - door display freezers launched in 2025 use zero - degree defrosting technology and EC energy - saving fans, reducing energy consumption by 30% compared with the previous generation. It has served global retail giants such as Walmart and Costco.

Epta

The Italian company Epta is known for its energy - saving technology. Its GigaCube series vertical freezers use double - layer vacuum glass doors and an intelligent defrosting system, reducing energy consumption by 18% compared with traditional models. It has a procurement share of over 40% in European supermarket chains. The foldable freezer launched in 2025 can reduce its volume by 30% after the store closes, solving the space bottleneck in convenience stores.

Liebherr

Liebherr's vertical freezers are famous for their precise temperature control and durability. Its SFFSG 4001 laboratory freezer uses R290 refrigerant, with a temperature fluctuation of ±0.5℃, and supports WiFi/LAN remote monitoring. It has been certified by the European Medicines Agency (EMA) as a vaccine storage device.

Huamei Freezers

Huamei Freezers is the "hidden champion" of Chinese commercial freezers. The vertical freezers supplied to Guoquan use air - cooling technology to solve the icing problem of coil - tube refrigeration and achieve 48 - hour nationwide distribution through self - built logistics warehouses. Its intelligent freezers are equipped with cameras and gravity sensors, which can analyze product display data and help brand owners optimize the supply chain.

Xingxing Cold Chain

Xingxing Cold Chain focuses on supermarket and restaurant scenarios. Its LSC618Y two - door air - circulation display cabinet has a volume of 608 liters, uses a copper - tube evaporator and an antibacterial inner tank, and has a coverage rate of over 60% in chain stores such as Zhang Liang Malatang and Yihetang. In 2024, the export value of its vertical freezers increased by 28% year - on - year, and the share in the South American market increased to 12%.

Arneg

The Italian company Arneg has a place in the high - end commercial freezer field. Its CO₂ transcritical refrigeration freezers have a 90% reduction in carbon emissions compared with traditional models, have obtained EU green certification, and have a 25% penetration rate in Nordic organic food supermarkets. The intelligent freezer launched in 2025 integrates RFID chip recognition technology, which can automatically take inventory and generate replenishment reports.

III. Future Development Directions of the Industry

Intelligence and Data - driven

Leading enterprises are accelerating the layout of AIoT technology. For example, Panasonic's remote - monitoring system can predict equipment failures, and Liebherr's intelligent frost - free technology reduces the manual defrosting frequency by 80%. In the future, freezers will become "data nodes" at the retail terminal, optimizing product display and supply - chain management by analyzing consumer behavior.

Green Manufacturing and Sustainable Development

The application of environmentally friendly refrigerants (such as R290, CO₂) and recyclable materials will become the mainstream. For example, Arneg's CO₂ freezers have been applied on a large scale in Europe. Haier Smart Home reduces production energy consumption through a photovoltaic power station, reducing carbon emissions per unit product by 15%.

Emerging Markets and Scenario Expansion

Regions such as Southeast Asia and the Middle East, due to their weak cold - chain infrastructure, have become the fastest - growing markets. Hailong Cold Chain has reduced equipment costs by 20% through local cooperation in Indonesia and has a market share of over 25%. At the same time, new scenarios such as pharmaceutical cold chain and cross - border e - commerce are driving the demand for high - end freezers. Liebherr's medical - grade freezers have a gross profit margin of 30% in Pfizer's vaccine distribution project.

The refrigerated upright cabinet industry is experiencing technological iteration and market restructuring. Leading enterprises consolidate their advantages through technological innovation and global layout, while emerging brands seize niche markets with differentiated strategies. In the future, intelligence, greenness, and scenario - based applications will become the core of competition. Enterprises need to continuously break through in technology research and development, supply - chain efficiency, and user experience to gain the upper hand in the global cold - chain transformation.

Most popular More «

-

What is the price of a cake display cabinet in Mumbai?

-

Review of Pastry Countertop Display Cabinet T90C/T90S

-

What techniques are crucial for quality in glass cabinet manufacturing?

-

What are the models available for the Cooluma bread refrigerator with two shelves?

-

The Best Manufacturer of Commercial Italian Gelato Cabinets - Cooluma

-

What is the difference between 5 cake cabinets?

-

Why Are All-Glass Display Cases So Expensive?

-

Technical Parameters and Solutions for Commercial Cake Chillers

-

Coffee Display Equipment Full Dimension Strategy

-

Cooluma Best Countertop Cake Refrigerator